s corp tax rate calculator

For the math nerds out there 200 - 50 x 05 25. The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800.

How Much Does A Small Business Pay In Taxes

However when Congress lowered the corporate tax rate it also created a new qualified business income QBI deduction.

. Your corporation tax bill is nine months and one day following the end of your accounting period. Obviously there are many. Before using the calculator you will need to.

Say you earn 150000 in revenue as the owner. Gross to Net Net to Gross Tax Year. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Be sure to add all your details in the more accurate. By choosing to be treated as an S-Corp. Normally these taxes are withheld by your employer.

Ad Easy To Run Payroll Get Set Up Running in Minutes. Taxes Paid Filed - 100 Guarantee. AS a sole proprietor Self Employment Taxes paid as a Sole.

PAYROLL TAX BURDEN AS AN EMPLOYEE Self-employment tax burden as an entrepreneur 765 765 153 Employees Tax Burden. This application calculates the federal income tax of the founders and company the California state franchise tax and fees the self-employment tax for LLCs and S-Corps pass-through. Our calculator will estimate whether electing S corp will result in a tax win for your business.

Forming an S-corporation can help save taxes. Additional Self-Employment Tax Federal Level 153 on all business income. Enter your estimated annual business net income and the reasonable salary you will pay.

For 2022 taxes this 20 deduction is available to. Until further notice the Township Administration Building including the Tax. OLPMS - Instant Payroll Calculator.

There is an extra 118 percent marginal tax rate caused by Pease limitations. Select a Transaction Type Purchase Bulk Construction Construction Conversion Leasehold Modification Refinance with Payoff Refinance with Consolidation Subordinate Mortgage. OLPMS - Instant Payroll Calculator.

If the end of your accounting period falls on 31 March 2022 youll need to. As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will drop to. The capital gains tax rate is no more than 15 for most individuals and some or all of net capital gain may be taxed at 0 if taxable income is less than 83350 as of 2022.

Now if 50 of those 75 in expenses was related to meals and entertainment then your taxable income would increase by 25 to 150. Wahler joins Biden. This additional tax covers Social Security Medicare taxes that would normally be paid on your W2 income S.

Taxes Paid Filed - 100 Guarantee. Determine a reasonable salary for the. S corporation owners are required to pay federal income taxes state taxes and local income tax.

21020 Annual Self Employment tax as an S-Corp 19125 You Save. From the authors of Limited Liability Companies for Dummies. Ad Does Your Business Need An LLC Or Corporation.

The corporation tax calculator allows companies in the UK and companies based outside the UK with offices or branches in the UK to calculate their corporation tax based on their companies. This calculator helps you estimate your potential savings. One of the top questions that clients ask is for real life example of how switching to a C Corp S corporation or LLC could benefit them from a tax perspective.

Standard deduction 12400 for 2020 single filers and Section 199A commonly called QBI. We are not the biggest. After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship.

Use this calculator to get started and uncover the tax savings youll receive as an S Corporation. This calculator applies the following. Lets look at some numbers to see how this works.

Fast Simple Formation With The Worry Free Services Support You Need To Be Successful. 1895 Total Savings From S-corp Conversion 1895 2 Review the Costs to Convert to S-Corp Initial state. Instead you only pay payroll taxes on the salary you earn from your S corp.

Lower municipal tax rate for four years in a row. Pick The Right Entity Type In Minutes.

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Getting To Know Gilti A Guide For American Expat Entrepreneurs

S Corp Tax Calculator Scorporation Taxes Taxpreparer Taxprofessional Taxpreneur Atlanta Georgia Scorp Scorp Payroll Taxes Llc Taxes Savings Calculator

The Basics Of S Corporation Stock Basis

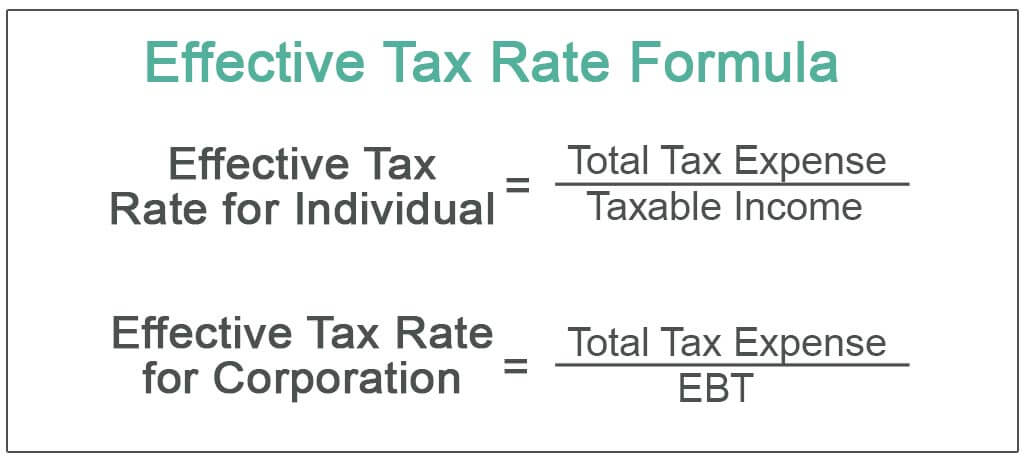

Effective Tax Rate Formula And Calculation Example

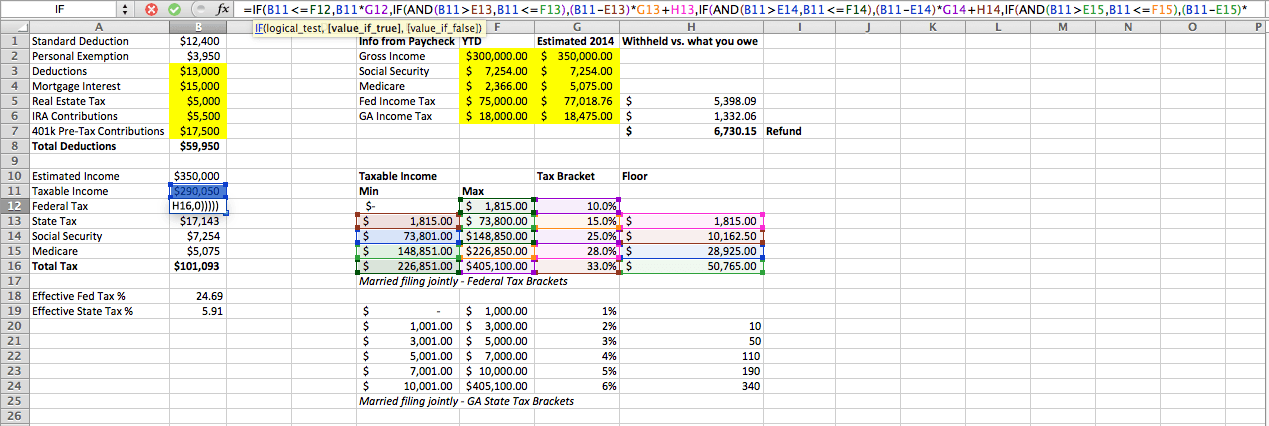

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Effective Tax Rate Definition Formula How To Calculate

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Corporate Tax Meaning Calculation Examples Planning

S Corp Tax Calculator Free Estimate Tax Debt Business Tax Tax Debt Relief

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Taxtips Ca Business 2020 Corporate Income Tax Rates

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

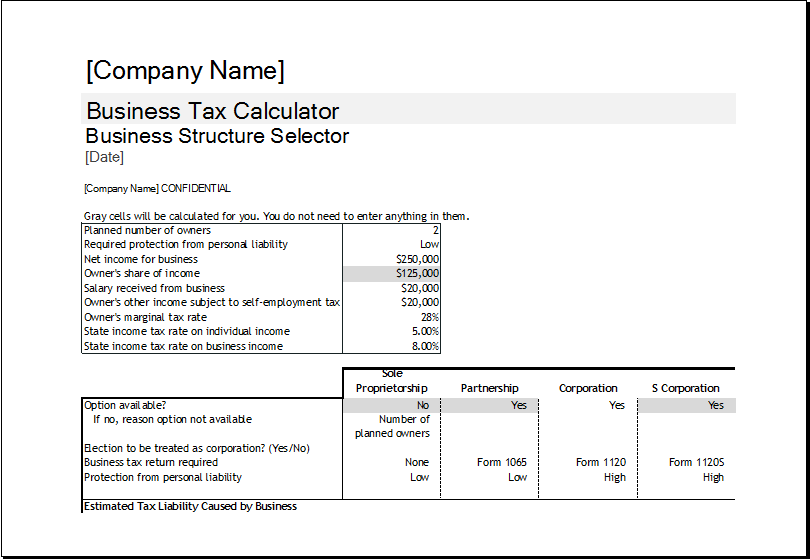

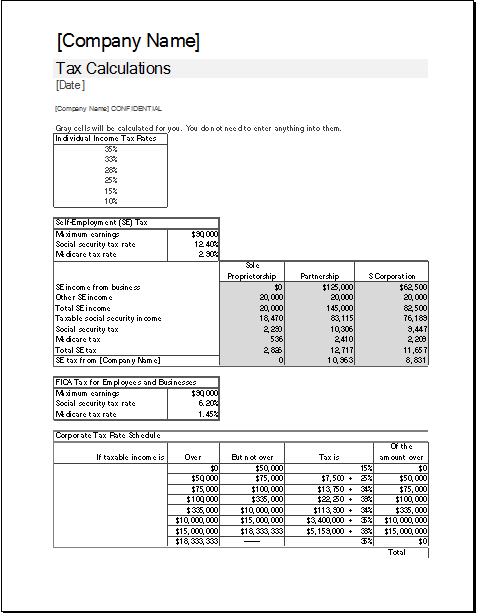

Corporate Tax Calculator Template For Excel Excel Templates

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Corporate Tax Calculator Template For Excel Excel Templates

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax